r&d tax credit calculation uk

12 from 1 January 2018 to 31 March 2020 13 from 1 April 2020 Published 1. SMEs can claim an RD tax credit through the SME RD tax incentive to SME RD relief allows companies to deduct an extra 130 of their qualifying costs from their yearly profit as well as the standard 100 deduction to make a total of 230 deduction and claim a tax credit if the company is loss-making worth up to 145 of the surrenderable loss.

R D Tax Credit Rates For Sme Scheme Forrestbrown

Then youll need to have the following figures on hand.

. Home RD Tax Credits Calculator. So if your RD spend last year was 100000 you could get a 25000 reduction in your tax bill. As of the end of December taxes will be incurred in India at a rate of Rs.

It was increased to. A range of incentives are available to enhance tax relief or provide cash credits to businesses of all sizes that are involved in innovation. Most companies in the UK that claim RD tax relief fit into the SME category.

How to make an RD tax credit claim There are four ways to make a claim for RD tax credits. Supports Profit and Loss making companies. February 17 2022.

Guidance on this can be found on our Which RD scheme is right for my company page. Calculate My Claim. 4 The RD tax credit was first established in 1981 in the Economic Recovery Tax Act ERTA.

1000000 x 12 120000 above the line credit 120000 19 corporation tax rate 97200. The amount of children tax credit you receive is. How much could you claim.

In India there are a 30 reduction in tax and a 20 reduction in tax in the Foreign country. The RD Tax Credit Calculator is best viewed in Chrome or Firefox. Estimate RD tax relief for your business.

Our RD tax credit calculator Our RD tax credits calculator only gives a rough estimate of the potential corporation tax saving or RD tax credit payable that you may be eligible to claim. For profit-making businesses RD tax credits reduce your Corporation Tax bill. Read our in-depth guide to grant funding and RD claims to find out more.

Enter your sub-contracted costs that are directly related to RD projects. RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount. Calculate RD tax relief in under 3 minutes.

Select whether the company is profitable or loss making. Eligibility Calculator RD Tax Credits are a very niche part of the UK tax code that could bring your company thousands of pounds in tax relief Complete the form below to find out how much you could claim. How to Calculate RD Tax Credit for SMEs.

The above RD tax credit calculation example shows several steps to arrive at the corporation tax saving. First however the fix-based percentage must be obtained by dividing the QREs for tax years during a base period by the gross receipts from the same period. RD Tax Credit Calculation Before you can calculate the amount you receive in RD tax credit carryforward youll need to ensure that your business is located in the US and pays tax.

If the company spent 100000 on RD projects in a year then its potential RD Credit would be. We recommend a thorough review to make sure you identify all qualifying RD projects and all eligible costs. Each year the average value of claims tend to increase.

2 days agoHow To Calculate Foreign Tax Credit Relief Uk. From 16385 in 2020-21 we will be increasing. Just follow the simple steps below.

According to the Joint Committee on Taxations JCT most recent tax expenditure report the RD tax credit will reduce tax revenue by about 118 billion in 2020106 billion for corporations and 12 billion for individuals. For each child tax credit you get in tax year 2021-22 you need less than 16480 in income. What Is The Income Limit For Child Tax Credit 2020 Uk.

Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief. Corporation Tax Saving. If a companys activities qualify for the RD credit there are two ways to calculate it.

It is based upon your RD costs entered. Profitable and loss making large companies equaly can benefit both potentially obtaining a RD Credit of 97 of their RD spend. The RDEC is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017.

Claim Amount In 2019-20 the average UK SME claim was 57228 and RDEC claim was 332160. The credit is calculated at 13 of your companys qualifying RD expenditure this rate applies to expenditure incurred on or after 1 April 2020 and is taxable. The UK Government introduced research and development tax credit schemes RD schemes in the year 2000 to encourage scientific and technological innovation within the UK.

Traditional method Under the traditional method the credit is 20 of the companys current year qualified research expenses over a base amount. Total number of employees in your business Companys revenue range Annual net expenditure on RD activities. The rate of relief is 25.

Depending if your company is profit. Select either an SME or Large company. The rate at which businesses calculate their RD tax credit depends on whether they are making a profit or a loss.

RDEC Scheme calculation that was either profit or loss making and spent 1000000 on qualifying RD activities in a given year. The rate at which the SME RD incentive is calculated depends on whether your business is profit- or loss-making. This can include freelance sub-contractors that are actively involved in development activities as well as agency labour cost which is restricted to 65 of the invoice value 0 50000 100000 250000 Other Amount.

This is a company that made 10000000 profit that year with qualifying RD spend of 3000000 and corporation tax of 1900000. Use our simple calculator to see if you qualify for the RD tax credit and if so by how much. Helping business owners for over 15 years.

For a profit-making business an RD tax credit reduces its corporation tax bill at a relief rate of 25. The credit benefits large and small companies in virtually every industry yet our research shows many businesses are leaving money on the table.

R D Tax Credit Rates For Rdec Scheme Forrestbrown

Rdec 7 Steps R D Tax Solutions

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Rates For Rdec Scheme Forrestbrown

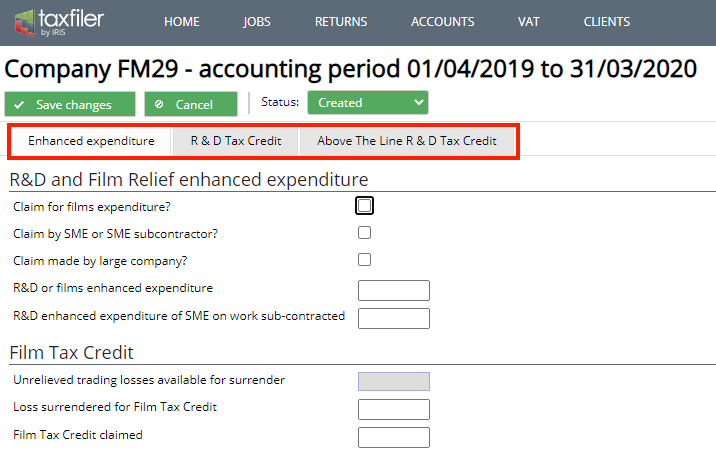

Research And Development Or Film Relief And Tax Credits Support Taxfiler

R D Tax Credit Calculation Examples Mpa

Rdec Scheme R D Expenditure Credit Explained

R D Tax Credit Calculation Examples Mpa

Payment Of Tax Invoices Bills Concept Financial Calendar Money Magnifying Glass Accounting Tax Forms